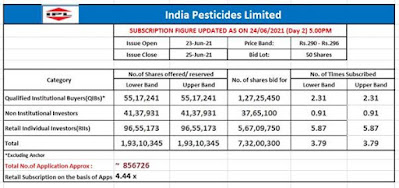

India Pesticides Limited Issue subscribed 3.79 times, Retail portion booked 5.87 times on day 2

June 24, 2021: India Pesticides Limited (“IPL”), a R&D driven one of the fastest growing agro-chemicals company and manufacturer of Technicals and APIs; received bids of 7,31,35,100 shares against the offered 1,93,10,345 equity shares, as per the 5:00 pm data available on the bourses.

The portion reserved for retail investors was subscribed 5.87 times and the Non-Institutional Investor category was subscribed 0.91 times, While the Qualified Institutional Buyer category was subscribed 2.31 times.

The total size of the offer is Rs. 800 crores at the upper price band of Rs. 296 per share.

Key brokerage houses like Angel Broking, Anand Rathi, Antique, Motilal Oswal, Prabhudas Lilladher and ICICI Direct have given recommendations of "Subscribe" to the issue for long term perspective while highlighting the key strengths of the company like (a) Diversified and expanding product portfolio (b) Healthy balance sheet with negative Net Debt to Equity and robust financials, having one of the best ROE and ROCE of 34% and 45% respectively (c) Sole Indian manufacturer of technicals which are exported to over 25 countries (d) Strong R&D and long term relations with key customers. Furthermore, the company is plans to expand its capacity by 10,000 MT which analysts believe will drive future growth and aid in gaining market share. To add to this many multinationals are taking steps to reduce dependency on China for their manufacturing operations and looking at India as an alternative which can be beneficial for companies like India Pesticides Ltd (IPL). Also, over the next five years technicals worth $4.2 billion are expected to go off patent which augurs well for IPL.

The world population is estimated to be growing at the rate of 70 to 80 million per year which has led to higher demand for food crops for which advanced agricultural practices are necessary. The global agrochemicals market was valued at US$62.5 billion in 2019 and is forecast to reach US$86 billion by 2024 growing at a CAGR of 6.6%. Indian crop protection chemicals exports have grown at 9% CAGR between 2015 and 2019. The actual export contribution of crop protection chemicals was 50% of total domestic production (by value) in 2019. Exports are projected to grow to ~55% in 2024, in terms of value. In 2024, exports are expected to grow to US$3.1 billion contributing 55% of total domestic production, which is expected to be valued at US$5.7 billion. Analysts believe that favourable industry dynamics along with strong track record of the company augur well for investors.

Axis Capital Limited and JM Financial Limited are the BRLMs to the Offer.

Company Information

The Company is the sole Indian manufacturer of five Technicals and among the leading manufacturers globally for Captan, Folpet and Thiocarbamate Herbicide, in terms of production capacity (Source: F&S Reports*). Certain key fungicide Technicals the Company manufactures include: (i) Folpet, used to manufacture fungicides that control fungal growth at vineyards, cereals, crops and biocide in paints; and (ii) Cymoxanil, used to manufacture fungicides that control downy mildews of grapes, potatoes, vegetables and several other crops. Major herbicide Technicals the Company manufactures include, Thiocarbamate herbicides that have application in field crops, such as, wheat and rice, and are used globally.

The Company currently operates out to 2 manufacturing facilities out of the Lucknow and Hardoi in Uttar Pradesh having an aggregate capacity of 19,500 MT for Technicals and 6,500 MT for the Formulations vertical. It currently has registrations and licenses for 22 agro-chemical Technicals and 125 Formulations for sale in India and 27 agro chemical Technicals and 35 Formulations for exports purpose and 2 APIs.

(Subscription table below)

Comments

Post a Comment